We believe Environmental, Social and Governance (“ESG”) investing – when done right – can mitigate risks, create substantial, risk-adjusted returns and positively impact our shareholders, employees and broader communities.

ESG investing is a sustainability-driven investment framework that Foursan has adopted since 2008 to assess companies’ operations, strategy and performance. ESG is thus strongly embedded into our culture and investment process. We believe taking a comprehensive approach to evaluating risks and driving impact leads to better investment outcomes.

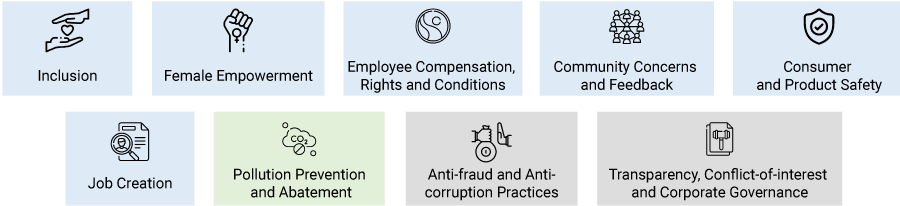

ESG principles are essential to assessing both downside protection (e.g., operational safety or potential environmental liability) as well as in value creation (energy efficiency, proper waste management, appropriately incentivizing workers).

Our Approach

Holistic Investment Process. ESG factors are critical and integral to investment decisions and performance. In addition to Foursan’s rigorous financial and business analysis, ESG criteria shed light on the quality of a company’s business, management, culture and overall risk profile. ESG is a key component of our investment process and approach to creating long-term value to all stakeholders.

Stakeholder Engagement. A core tenet of our investment process and philosophy is maintaining active dialogue with a variety of stakeholders, including company shareholders; senior, mid-level and junior employees; suppliers; and customers. Active dialogue with these constituents allows us to better understand a company’s business drivers, risks, strategy, culture and team dynamics, which we believe are critical to an assessment of a company’s long-term prospects.

|

Our Fiduciary Responsibility to Investors and Partners

We encourage any concerns or complaints in relation to the conduct of our business, our people or any of our portfolio companies to be brought to our attention by contacting us per the mechanism detailed in our External Grievances policy.